blog →

Hiring Trends in Climate Tech - observations from the 2024 MIT Energy Conference

Steven’s note: this is a guest blog post from Lucas Kasser, a senior software engineer at a climate tech company and former user of ClimateTechList.

Summary:

- This post contrasts the effect of the “Green Revolution” vs the “Information Revolution” on American skilled labor.

- The “Information Revolution” has largely failed to create skilled labor jobs, even as it’s created immense economic value

- Traditional manufacturing creates skilled labor jobs, but has issues with offshoring those jobs, as well as requiring a lot of capital in order to scale

- Climate tech startups (”Green revolution”) more closely resemble traditional manufacturing, but have the advantage of access to substantial government subsidies. These will become a massive source of skilled labor jobs

I recently had the pleasure of attending the 2024 MIT Energy Conference, which had a diverse array of talks from industry and policy experts, as well as a large number of climate tech startups. One of the prevailing themes I was struck by during the conference was that, if we are able to transition our economy in a way that prevents climate catastrophe, there will be a massive influx of well-paying, skilled labor jobs created by novel climate tech startups.

The claim of ““economic revitalization vis a vis climate tech” tends to create understandable skepticism. American manufacturing has been progressively hollowed out in favor of cheaper off-shore labor. Also, the more recent economic revolution (the Information Revolution), largely failed to create skilled labor jobs even as it created immense economic value.

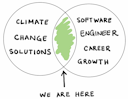

This article will examine the lifecycle of three types of startups: “traditional” software companies (the most common participant in the Information Revolution), “traditional” manufacturing / physical goods startups, and “climate tech” startups (a.k.a. “greentech” and “cleantech”). I will argue that unlike the other two, “climate tech” companies are the best suited to create a large influx of skilled labor jobs in America.

Importantly, while we only discuss startups in this article, the climate transition will necessarily involve established incumbents like energy utilities (e.g., to upgrade power lines for new solar capacity). These incumbents will also likely need to expand their need for skilled labor, but perhaps will not have the same level of net job creation as a successful startup.

“Traditional” Software Startups

Let’s talk about a traditional software startup, and why it generally does not create skilled labor jobs. Here is the funding lifecycle of a traditional software company:

- (Optional) Research lab develops novel solution, or solution arises naturally from business need

- Startup formed to commercialize solution. Founders raise money from venture capital firms, in exchange for equity stake in the company.

- Using the venture capital infusion, the startup hires a few highly paid software engineers, and some supporting business staff (marketing, HR, sales, customer support, etc). Engineers build out MVP

- The startup sells the product to some customers, generating revenue. The startup reinvests the revenue and refines the product until the business has a net-positive revenue cycle. The business then IPOs, raising more money for growth and allowing equity holders to convert equity stake to cash (including initial VC partners and founders).

.png?table=block&id=0ac97d30-1b64-49a4-a566-b6750c504321&cache=v2)

Importantly, the key value proposition of software startups is that labor cost is decoupled from revenue generation. Scaling software is “free”, as opposed to selling physical devices which require materials and labor costs to scale with production volume. This makes software startups very appealing to investors, as they can get extremely large ROI in a relatively short time frame.

In addition, because software is virtual, it’s a decentralized product. Therefore, rather than creating jobs in local communities, the “Information Revolution” has largely created a few very highly paid jobs in wealthy areas of the country (SF, NYC), even though the products are used across the world.

To reiterate, software startups are appealing to investors because of their low labor needs. Pure software companies can avoid or limit blue collar job creation, and return that revenue to equity holders.

“Manufacturing” Startup

By comparison, a “manufacturing” startup produces a physical product. As the production is physical, scaling out the production process tends to be quite capital intensive, and the timescales can be much longer. The skeleton of the funding lifecycle is similar, however:

- Research lab develops novel solution / material (e.g., MIT materials science lab)

- Company formed to commercialize the solution (sometimes via an academic/industry partnership like MIT’s The Engine). Founders attempt to raise money to scale deployment

- A few highly skilled (and paid) engineers / scientists are hired to build MVP / proof of concept, and iterate on the most effective prototypes

- Company builds physical facility to scale product, creating many blue collar jobs in the local community

- Company sells product to customer, generating revenue, and uses revenue to continue to scale

_(1).png?table=block&id=7c52aeeb-7a08-4590-85ad-a5c588bab854&cache=v2)

These startups do create many skilled labor jobs (although sometimes the jobs are offshore), but because scaling production is difficult, they tend to be less appealing to investors. The difficulty of raising initial capital can suppress the growth of these startups.

“Climate Tech” Startups

Climate change is ultimately a physical problem, and the majority of effective solutions involve building new physical systems and changing existing physical processes (e.g., electricity generation, carbon capture, industrial manufacturing processes). Companies created to scale these physical solutions will look more like the “manufacturing” startups, and less like the “software” startups. If successful, these startups will therefore create many skilled labor jobs.

That said, given that “climate tech” startups are similar to manufacturing startups, they also encounter similar challenges. Why do we expect them to succeed where their non-climate-tech counterparts have failed? In short: government intervention.

The current US federal government administration recognizes climate change as an existential threat, so it has put significant effort towards nurturing green-tech companies by:

- Providing grants to climate labs and early-stage startups pursuing impactful research (like The Engine at MIT)

- Providing non-dilutive, low-interest loans to early-stage startups so that they can scale

- Creating revenue sources by providing tax credits for otherwise non-economically viable industries (e.g., carbon capture)

Therefore, this class of startups has significant additional sources of early-stage funding, not accessible to non-climate-tech startups. According to Emily Knight, President of MIT’s The Engine, these additional revenues of capital provide significant assistance to early-stage climate tech startups looking to scale their solutions:

_(2).png?table=block&id=d63f22b1-b329-43d3-ac93-7a0cb43f3cfb&cache=v2)

In addition, because the funding is being supplied by the US federal and state governments, these startups will be more inclined to invest in US-based facilities, rather than going off-shore. Unlike the Information Revolution where the jobs were largely concentrated in cities, these facilities will be created in more rural regions in the US, where the cost of land, power, and labor is cheaper. As examples:

- Form Energy, an MIT battery startup, just opened a factory in West Virginia

- Commonwealth Fusion Systems (a fusion startup) has built a prototype facility in Devens, MA

- Sublime Systems, a carbon-neutral cement startup, is building a factory in Holyoke, MA

Conclusion

In conclusion, we are seeing the start of a new wave of climate tech startups. Because they deal with physical systems, they will be a massive source of skilled labor jobs, in contrast to traditional software tech startups. In addition, because of their access to government-provided capital, they are better positioned to succeed than their traditional manufacturing counterparts.

Join the ClimateTechList

Talent Collective →

GET NOTIFIED ABOUT

New high-impact climate tech companies & jobs

No spam. Unsubscribe any time.

Featured Blog Posts

Join the ClimateTechList

Talent Collective →

GET NOTIFIED ABOUT

New high-impact climate tech companies & jobs

No spam. Unsubscribe any time.

Featured Blog Posts